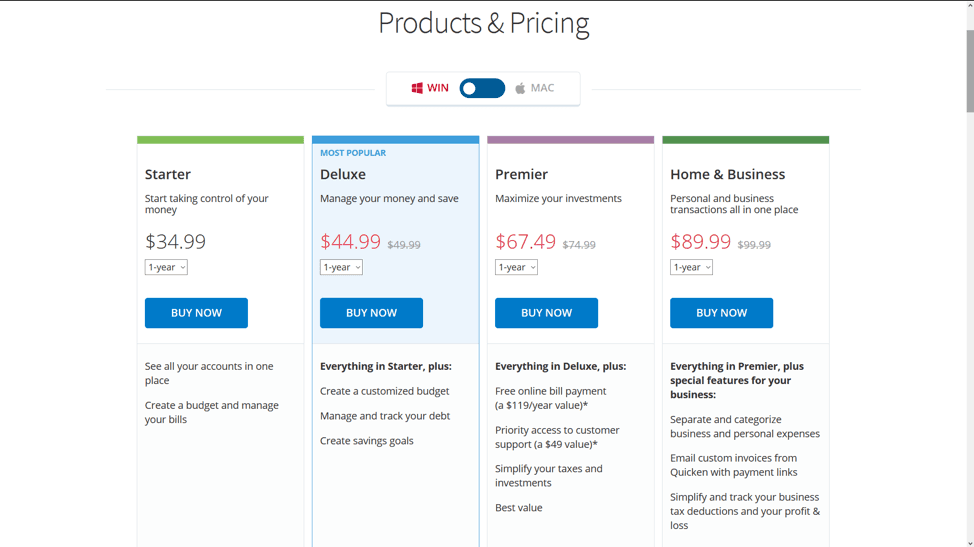

Cost - Winner: MintĪll Mint's financial tools are free. Which tool wins out in a head-to-head battle? Let's take a more detailed look at how the two compare. However, note that Mint offers all of these for free, while you have to pay a subscription fee for Quicken. View balances on accounts and overall net worth.Mint and Quicken both offer the following features: Special Features: Bill pay, retirement planner, tax planner, accounting and property management, create tax reports, export into TurboTax.

#What is quicken mint Offline#

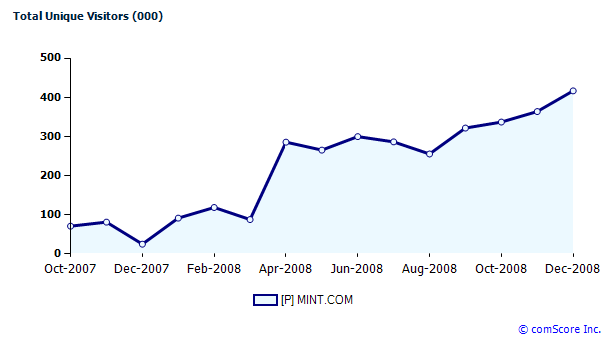

Special Features: View net worth, track progress toward goals, customized alerts, free credit monitoring.Platform: Online web- and app-based platform.Quicken is better for those with more advanced budgeting needs, including managing business finances and properties.įirst, let's take a quick look at where Mint and Quicken differ. Mint is better for casual budgeters and day-to-day money management. Quick Takeaway: Which is better-Mint or Quicken? Intuit bought Mint in 2009 and still owns it. Mint launched in 2006 and was quickly dubbed the "Quicken killer." Unlike Quicken, Mint instantly synced all your banking and credit card accounts so that you can see your finances in real-time from anywhere.īoth Quicken and Mint were owned by Intuit at one point. It offers comprehensive financial tools including budgeting, bill pay, investment tracker, and property and business accounting tools. Quicken is a subscription-based desktop software. It allowed people to gather all their finances in one place and quickly perform tasks that were usually done on paper. Property & Small Business Management - Winner: Quickenįounded by Intuit in 1983, Quicken is the granddaddy of personal finance software.Synching & Accessibility - Winner: Mint.

0 kommentar(er)

0 kommentar(er)